Patrick County Va Real Estate Taxes . Citizens can pay the following at the. Find all patrick county, va tax records here. Tax rates differ depending on where you live. The patrick county treasurer's office, located in the patrick county administration building, is responsible for collecting and managing county. Virginia localities are authorized to levy taxes on real property, including land and buildings. Access property tax assessments, payments, exemptions, and delinquent tax sales. Easily explore patrick county, va property records. Explanation of taxes real estate. The treasurer's office is responsible for the collection and safekeeping of county revenue. The patrick county assessor is responsible for appraising real estate and assessing a property. Use the directory to find. If you have questions about personal property tax or real estate tax, contact your local tax office. The real estate tax rate for 2023 is 0.73 per 100. Access mortgage, real estate, boundary, survey, and ownership records.

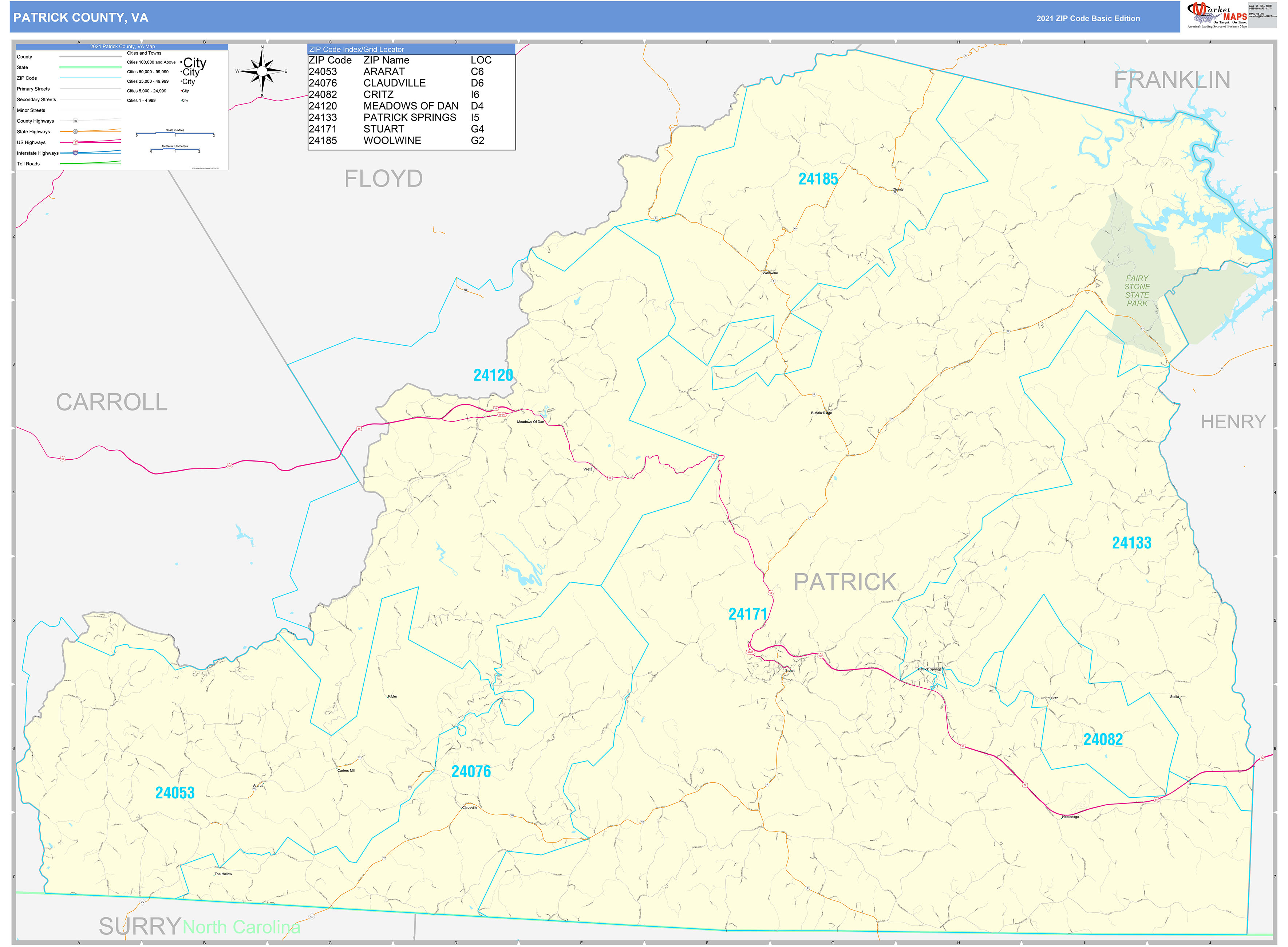

from www.mapsales.com

The treasurer's office is responsible for the collection and safekeeping of county revenue. Virginia localities are authorized to levy taxes on real property, including land and buildings. Easily explore patrick county, va property records. The patrick county assessor is responsible for appraising real estate and assessing a property. Tax rates differ depending on where you live. The patrick county treasurer's office, located in the patrick county administration building, is responsible for collecting and managing county. Find all patrick county, va tax records here. If you have questions about personal property tax or real estate tax, contact your local tax office. Access mortgage, real estate, boundary, survey, and ownership records. The real estate tax rate for 2023 is 0.73 per 100.

Patrick County, VA Zip Code Wall Map Basic Style by MarketMAPS MapSales

Patrick County Va Real Estate Taxes Easily explore patrick county, va property records. The patrick county assessor is responsible for appraising real estate and assessing a property. Access mortgage, real estate, boundary, survey, and ownership records. Virginia localities are authorized to levy taxes on real property, including land and buildings. The real estate tax rate for 2023 is 0.73 per 100. The patrick county treasurer's office, located in the patrick county administration building, is responsible for collecting and managing county. Access property tax assessments, payments, exemptions, and delinquent tax sales. Tax rates differ depending on where you live. Citizens can pay the following at the. Find all patrick county, va tax records here. The treasurer's office is responsible for the collection and safekeeping of county revenue. Easily explore patrick county, va property records. If you have questions about personal property tax or real estate tax, contact your local tax office. Explanation of taxes real estate. Use the directory to find.

From www.realtor.com

Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes Virginia localities are authorized to levy taxes on real property, including land and buildings. The treasurer's office is responsible for the collection and safekeeping of county revenue. The patrick county assessor is responsible for appraising real estate and assessing a property. Access property tax assessments, payments, exemptions, and delinquent tax sales. The real estate tax rate for 2023 is 0.73. Patrick County Va Real Estate Taxes.

From www.realtor.com

Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes The treasurer's office is responsible for the collection and safekeeping of county revenue. Easily explore patrick county, va property records. Find all patrick county, va tax records here. Citizens can pay the following at the. Access property tax assessments, payments, exemptions, and delinquent tax sales. The patrick county assessor is responsible for appraising real estate and assessing a property. The. Patrick County Va Real Estate Taxes.

From www.realtor.com

Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes If you have questions about personal property tax or real estate tax, contact your local tax office. Find all patrick county, va tax records here. The treasurer's office is responsible for the collection and safekeeping of county revenue. Access property tax assessments, payments, exemptions, and delinquent tax sales. Tax rates differ depending on where you live. Access mortgage, real estate,. Patrick County Va Real Estate Taxes.

From www.realtor.com

Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes Citizens can pay the following at the. The patrick county assessor is responsible for appraising real estate and assessing a property. Access mortgage, real estate, boundary, survey, and ownership records. Access property tax assessments, payments, exemptions, and delinquent tax sales. Use the directory to find. The patrick county treasurer's office, located in the patrick county administration building, is responsible for. Patrick County Va Real Estate Taxes.

From www.realtor.com

Page 3 Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes The treasurer's office is responsible for the collection and safekeeping of county revenue. Use the directory to find. Citizens can pay the following at the. If you have questions about personal property tax or real estate tax, contact your local tax office. The patrick county treasurer's office, located in the patrick county administration building, is responsible for collecting and managing. Patrick County Va Real Estate Taxes.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Patrick County Va Real Estate Taxes Access property tax assessments, payments, exemptions, and delinquent tax sales. Easily explore patrick county, va property records. Use the directory to find. Access mortgage, real estate, boundary, survey, and ownership records. The patrick county assessor is responsible for appraising real estate and assessing a property. The patrick county treasurer's office, located in the patrick county administration building, is responsible for. Patrick County Va Real Estate Taxes.

From www.mapsales.com

Patrick County, VA Wall Map Premium Style by MarketMAPS Patrick County Va Real Estate Taxes The treasurer's office is responsible for the collection and safekeeping of county revenue. Access mortgage, real estate, boundary, survey, and ownership records. Find all patrick county, va tax records here. Virginia localities are authorized to levy taxes on real property, including land and buildings. Access property tax assessments, payments, exemptions, and delinquent tax sales. If you have questions about personal. Patrick County Va Real Estate Taxes.

From www.realtor.com

Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes Access property tax assessments, payments, exemptions, and delinquent tax sales. Explanation of taxes real estate. The real estate tax rate for 2023 is 0.73 per 100. If you have questions about personal property tax or real estate tax, contact your local tax office. The treasurer's office is responsible for the collection and safekeeping of county revenue. Use the directory to. Patrick County Va Real Estate Taxes.

From homes.swvarealty.com

Patrick County Real Estate Patrick County Va Real Estate Taxes Access property tax assessments, payments, exemptions, and delinquent tax sales. Use the directory to find. Access mortgage, real estate, boundary, survey, and ownership records. Tax rates differ depending on where you live. The treasurer's office is responsible for the collection and safekeeping of county revenue. Easily explore patrick county, va property records. Find all patrick county, va tax records here.. Patrick County Va Real Estate Taxes.

From www.usnews.com

How Healthy Is Patrick County, Virginia? US News Healthiest Communities Patrick County Va Real Estate Taxes Easily explore patrick county, va property records. Access mortgage, real estate, boundary, survey, and ownership records. If you have questions about personal property tax or real estate tax, contact your local tax office. The patrick county treasurer's office, located in the patrick county administration building, is responsible for collecting and managing county. The patrick county assessor is responsible for appraising. Patrick County Va Real Estate Taxes.

From www.rogersauctiongroup.com

Patrick County Tax Sale Online Only Patrick County Va Real Estate Taxes The treasurer's office is responsible for the collection and safekeeping of county revenue. Tax rates differ depending on where you live. Easily explore patrick county, va property records. Citizens can pay the following at the. Virginia localities are authorized to levy taxes on real property, including land and buildings. The patrick county treasurer's office, located in the patrick county administration. Patrick County Va Real Estate Taxes.

From www.realtor.com

Patrick County, VA Real Estate & Homes for Sale Patrick County Va Real Estate Taxes The treasurer's office is responsible for the collection and safekeeping of county revenue. The patrick county assessor is responsible for appraising real estate and assessing a property. The real estate tax rate for 2023 is 0.73 per 100. The patrick county treasurer's office, located in the patrick county administration building, is responsible for collecting and managing county. Citizens can pay. Patrick County Va Real Estate Taxes.

From www.blackswanbooks.com

HISTORY OF PATRICK COUNTY, VIRGINIA Patrick County Historical Society Patrick County Va Real Estate Taxes The real estate tax rate for 2023 is 0.73 per 100. Access property tax assessments, payments, exemptions, and delinquent tax sales. Explanation of taxes real estate. Tax rates differ depending on where you live. The patrick county assessor is responsible for appraising real estate and assessing a property. The treasurer's office is responsible for the collection and safekeeping of county. Patrick County Va Real Estate Taxes.

From www.dailysignal.com

How High Are Property Taxes in Your State? Patrick County Va Real Estate Taxes Find all patrick county, va tax records here. Citizens can pay the following at the. The real estate tax rate for 2023 is 0.73 per 100. Tax rates differ depending on where you live. If you have questions about personal property tax or real estate tax, contact your local tax office. Access mortgage, real estate, boundary, survey, and ownership records.. Patrick County Va Real Estate Taxes.

From www.landsofamerica.com

78.05 acres in Patrick County, Virginia Patrick County Va Real Estate Taxes Explanation of taxes real estate. Citizens can pay the following at the. The real estate tax rate for 2023 is 0.73 per 100. Virginia localities are authorized to levy taxes on real property, including land and buildings. Use the directory to find. If you have questions about personal property tax or real estate tax, contact your local tax office. The. Patrick County Va Real Estate Taxes.

From www.mapsales.com

Patrick County, VA Zip Code Wall Map Basic Style by MarketMAPS MapSales Patrick County Va Real Estate Taxes Explanation of taxes real estate. The real estate tax rate for 2023 is 0.73 per 100. Access property tax assessments, payments, exemptions, and delinquent tax sales. Virginia localities are authorized to levy taxes on real property, including land and buildings. Use the directory to find. Tax rates differ depending on where you live. Easily explore patrick county, va property records.. Patrick County Va Real Estate Taxes.

From traveltasteandtour.com

Fall is a Magical Place in Patrick County, Virginia. Travel Taste and Patrick County Va Real Estate Taxes The real estate tax rate for 2023 is 0.73 per 100. Access mortgage, real estate, boundary, survey, and ownership records. The patrick county assessor is responsible for appraising real estate and assessing a property. Virginia localities are authorized to levy taxes on real property, including land and buildings. Access property tax assessments, payments, exemptions, and delinquent tax sales. Easily explore. Patrick County Va Real Estate Taxes.

From www.pinterest.com

Street map of Patrick County, Virginia Map, County map, Virginia Patrick County Va Real Estate Taxes Tax rates differ depending on where you live. Access mortgage, real estate, boundary, survey, and ownership records. The patrick county assessor is responsible for appraising real estate and assessing a property. Easily explore patrick county, va property records. If you have questions about personal property tax or real estate tax, contact your local tax office. Virginia localities are authorized to. Patrick County Va Real Estate Taxes.